All your company and group assets should be managed and stored via a single database, without the need to switch between multiple systems.

Your finance departments should be able to quickly approve fixed asset POs or invoices through workflow approvals and Apps. Plus, have the ability to upload accompanying documents via a document management functionality, schedule dates for maintenance or renewal, and link assets to leases or loans.

How do you go about managing your assets with automated depreciation journals and a fixed asset schedule, using CapEx forecasting for greater assistance in your financial planning?

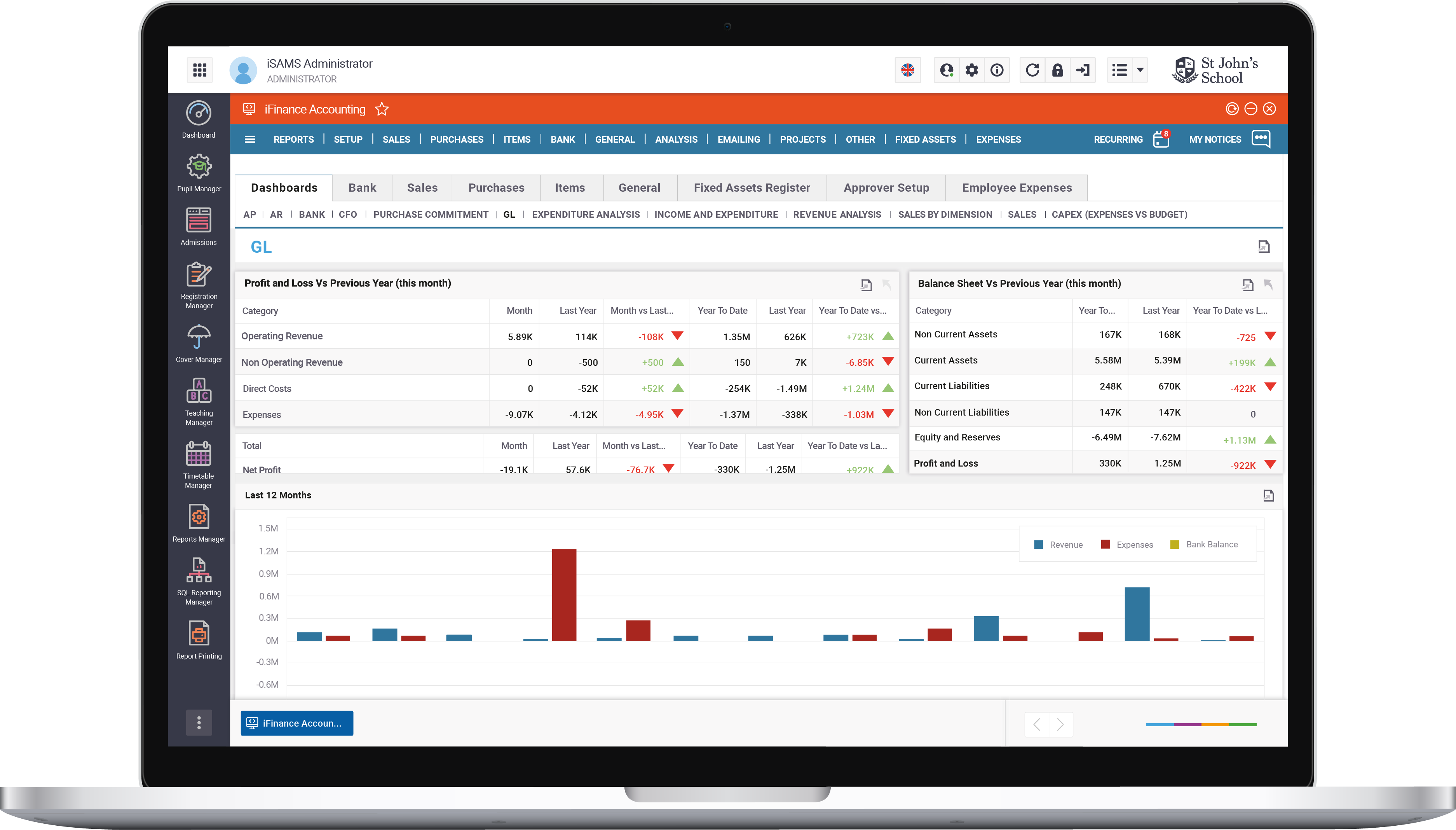

One of our central aims continues to be increasing efficiency across each of our partner schools, whilst enhancing the experience for every member of the school community. Specifically, with your Bursars and Finance teams in mind, this was the driving force behind our development of the iFinance – a platform which brings together your academic, wellbeing, administrative and fee billing elements with a powerful accounting and finance solution.

What is the Fixed Asset Register?

Say goodbye to hours spent battling with complex Excel spreadsheets, as all your school and group assets can now be managed and stored via this single database.

With the ability to upload accompanying documents and key information surrounding invoices, warranties and contracts, as well as the ability to link assets to leases or loans to ensure you have a clear paper trail of accountability, managing your school’s fixed assets has never been easier.

Create a new class

Navigate to the Fixed Asset Register and click on ‘New Class’. Here you’ll be able to enter a unique code and description to help you identify and trace this fixed asset. Following this, you will also be able to add a series of information to help you track the overall depreciation of the asset, including a Purchase GL, the legal Depreciation Method Rate, an Accumulated Depreciation Asset FL, a Depreciation Expense GL, an Annual Deprecation Rate, and more. Through this, you’ll be able to automate the depreciation journal of each fixed asset and clearly identify whether or not you’re profiting or losing money from each one.

Add a new fixed asset

From the central dashboard under the Fixed Asset Register, select ‘New Fixed Asset’. From here you will add a compulsory reference and be able to link the asset with an Asset Class, BI Code, Location, Supplier, a parent asset or asset extension, and more. This will help further automate your internal processes to avoid any duplication of data or hours spent manually inserting everything into a spreadsheet.

Manage existing assets

When you click to view an existing asset, you’re able to view a comprehensive collection of information relating to that asset. This includes details such as the warranty, insurance, maintenance, and leasing details. Storing all this information in a single place online will massively reduce the time spent on administrative tasks, simultaneously increasing the accessibility of important documentation.

Dispose of a fixed asset

Navigate to the asset you’d like to dispose of and click ‘Dispose’. This will open up a window in which you can enter the expense account you would like the asset linked to, and you’ll be able to view whether there was a financial gain or loss in the disposal of this asset. Clicking ‘Dispose and Process’ will permanently remove this asset from the register.

Use the Fixed Asset Register dashboard

The intuitive and easy-to-use dashboard is designed to give you an instant oversight over the fixed asset information your Finance teams need to get hold of quickly. You can attach documentation, add and remove columns and add filters for ease of reporting and sourcing information, and export the register into Excel for sharing and reporting purposes.

Find out why numerous iSAMS schools are looking to add iFinance to their software package – explore more about this powerful platform, including further details on using the Fixed Asset Register, here.

Sign up to receive our newsletter

Most Popular

- Celebrating International Women's Day in schools March 02, 2023

- Benefits of effective communication in schools April 10, 2024

- 7 Shocking Secrets to Crafting an Unbreakable School Timetable May 23, 2019

- 5 top tips to make writing your end of term report easier March 26, 2019

- The importance of benchmarking for schools July 24, 2023